Q: What is the Ansoff Matrix?

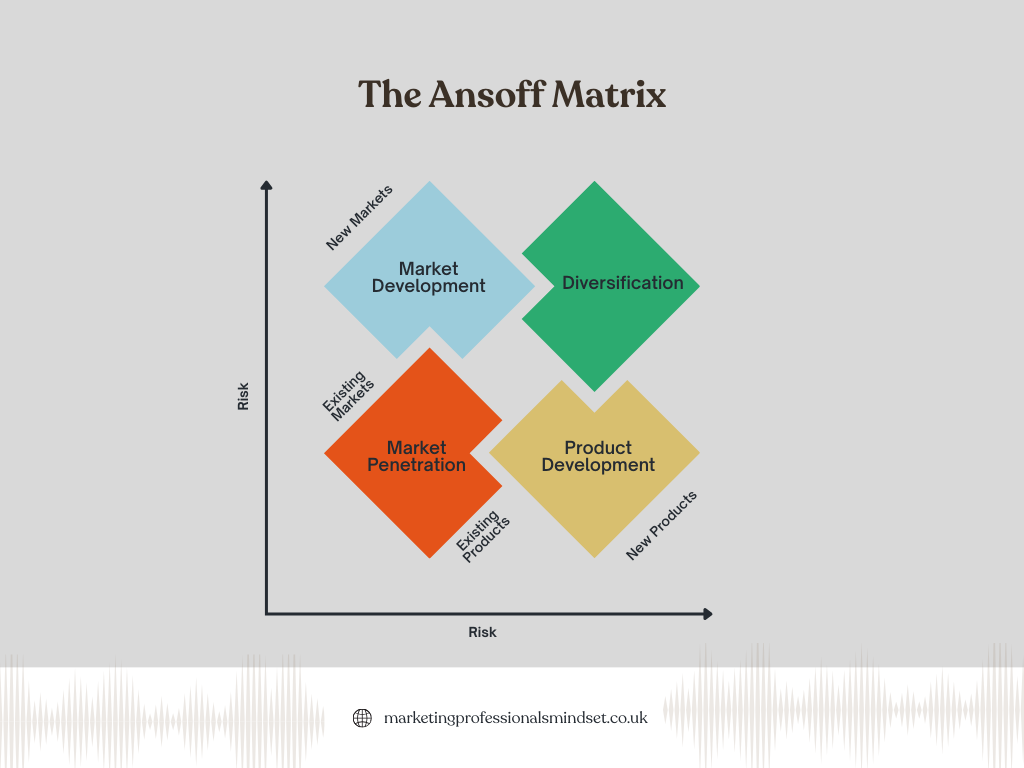

A: The Ansoff Matrix, also known as the Product/Market Expansion Grid, is a strategic planning tool developed by Igor Ansoff in 1957. It helps businesses analyze and plan their growth strategies by considering the options of new or existing products and new or existing markets. The matrix is a 2×2 grid that illustrates four distinct growth strategies, each carrying different levels of risk and requiring different approaches to execution. Its primary purpose is to help companies identify potential opportunities for growth and to understand the risks associated with each strategic direction.

Q: What are the four growth strategies identified by the Ansoff Matrix?

A: The Ansoff Matrix outlines four primary growth strategies, each representing a different combination of product and market:

- Market Penetration (Existing Product, Existing Market): This strategy focuses on increasing sales of existing products in existing markets. It involves tactics like increasing market share through competitive pricing, promotion, advertising, or improving distribution channels, often targeting current customers or attracting competitors’ customers. This is generally considered the lowest-risk strategy.

- Market Development (Existing Product, New Market): This strategy aims to introduce existing products into new markets. This could involve entering new geographic regions (domestic or international), targeting new customer segments within existing regions, or finding new uses for existing products. It requires understanding and adapting to the needs of the new market.

- Product Development (New Product, Existing Market): This strategy focuses on creating new products or significantly modifying existing ones to offer to existing markets. This often involves research and development (R&D) to innovate, improve product features, or introduce entirely new product lines that appeal to current customers.

- Diversification (New Product, New Market): This is the most complex and highest-risk strategy. It involves developing new products for new markets that are outside the company’s current core business. Diversification can be either related (e.g., leveraging existing capabilities in a new area) or unrelated (e.g., entering a completely new industry). While high-risk, it can offer high rewards and spread risk across different ventures.

Q: How does the Ansoff Matrix help businesses in their strategic planning?

A: The Ansoff Matrix is a valuable tool for strategic planning due to several key benefits:

- Identifies Growth Opportunities: It provides a structured framework to brainstorm and categorize potential growth avenues, ensuring that companies consider all four strategic directions.

- Assesses Risk: It inherently highlights the increasing level of risk associated with each strategy, moving from market penetration to diversification, allowing businesses to make informed decisions based on their risk tolerance and resources.

- Facilitates Resource Allocation: By clearly defining strategies, it helps in allocating resources (financial, human, technological) more effectively towards specific growth initiatives.

- Guides Decision-Making: It offers a clear picture of the strategic choices available, helping management choose the most suitable path based on the company’s current position, capabilities, and market conditions.

- Promotes Strategic Thinking: It encourages managers to think critically about their products, markets, and the potential future direction of the business, fostering a proactive approach to growth.

Q: What is the relationship between risk and the Ansoff Matrix strategies?

A: The Ansoff Matrix explicitly illustrates a gradient of risk associated with each growth strategy:

- Market Penetration is generally considered the lowest risk. Companies are dealing with familiar products and familiar customers, allowing for a clearer understanding of market dynamics and customer needs.

- Market Development and Product Development are considered medium risk. Market Development involves the uncertainty of new markets, requiring market research and adaptation. Product Development involves the uncertainty of new products, requiring R&D investment and potential for product failure, even if the target market is known.

- Diversification is the highest risk strategy. It combines the challenges of both new products and new markets, requiring significant investment, developing new competencies, and facing unfamiliar competitive landscapes. The lack of prior experience in either domain significantly increases the potential for failure, although successful diversification can lead to substantial rewards and market leadership.

This increasing risk factor is crucial for businesses to consider when formulating their growth strategies and planning resource deployment.

Q: Can you provide an example for each of the four Ansoff Matrix strategies?

A: Certainly, let’s use a hypothetical coffee shop chain, “Daily Brews,” as an example:

- Market Penetration: Daily Brews could offer loyalty programs, introduce a “buy one get one free” promotion during off-peak hours, or launch an aggressive local advertising campaign to encourage existing customers to visit more frequently or attract customers from rival coffee shops in their current locations.

- Market Development: Daily Brews, currently operating only in urban centers, might decide to open new outlets in suburban areas or expand into a different country. Alternatively, they could target a new customer segment, like setting up small kiosks inside universities or corporate offices, which they hadn’t previously focused on.

- Product Development: Daily Brews might introduce a new line of specialty, ethically sourced single-origin coffees, or launch a range of healthy grab-and-go breakfast items (sandwiches, pastries, fruit bowls) to cater to their existing customer base who are looking for more food options.

- Diversification: Daily Brews could decide to launch a brand of ready-to-drink bottled iced coffees sold through supermarkets (new product, new market channel/segment). A more extreme diversification might involve acquiring a chain of bakeries or even investing in coffee bean plantations in another country, entering new segments entirely unrelated to their existing retail coffee shop operations.

Q: What are the main limitations or criticisms of the Ansoff Matrix?

A: While a powerful tool, the Ansoff Matrix has several limitations:

- Oversimplification: It provides a high-level overview and simplifies complex strategic choices into four distinct categories, which might not fully capture the nuances of real-world business environments.

- Lacks External Factors: The matrix primarily focuses on internal product and market considerations but doesn’t explicitly account for crucial external factors such as competitor actions, regulatory changes, economic conditions, or technological advancements.

- No Guidance on “How”: It identifies potential strategies but doesn’t offer guidance on how to implement them, the resources required, or the specific tactics involved. It’s a framework for identifying options, not a detailed action plan.

- Doesn’t Assess Internal Capabilities: While risk is implied, it doesn’t directly assess a company’s internal capabilities, strengths, and weaknesses (e.g., R&D capacity, marketing expertise, financial stability) that are crucial for successful execution of any strategy.

- Risk Is Not Absolute: While it shows increasing risk, the actual level of risk for each strategy can vary significantly based on industry, company resources, market conditions, and management execution. For example, a “safe” market penetration strategy could fail if poorly executed or if a strong competitor enters the market.